Western Digital (WD, Nasdaq: WDC) reported strong fiscal Q2 2026 results, reflecting robust demand for its high-capacity hard drives. Revenue was $3.02 billion, up 25% year‑over‑year. The company’s GAAP gross margin rose to 45.7% (46.1% non‑GAAP), and non‑GAAP EPS was $2.13. Operating cash flow was $745M and free cash flow $653M. These results beat guidance on both the top and bottom lines.

- Revenue: $3.02B in Q2 FY2026 (up 25% YoY).

- Gross margin: 45.7% GAAP (46.1% non‑GAAP).

- Earnings: $4.73 GAAP diluted EPS (or $2.13 non‑GAAP).

- Cash generation: $745M operating cash flow; $653M free cash flow.

- Shipments: 215 exabytes of storage delivered (up 22% YoY).

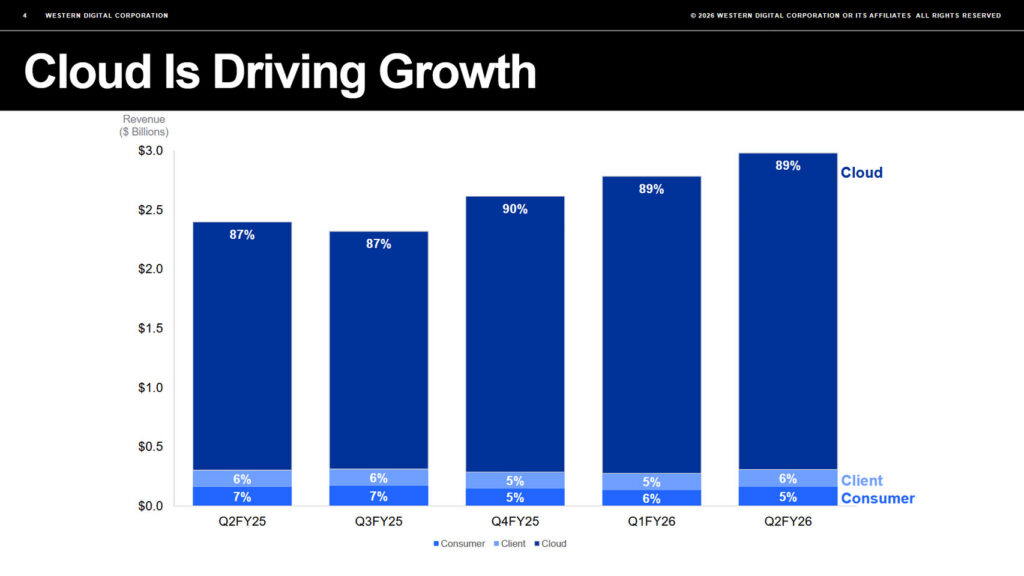

- Cloud segment: ~$2.7B, ~89% of sales.

Western Digital emphasized that this growth is tied to AI and data-center demand. As CEO Irving Tan noted, the quarter “reflects our disciplined execution to meet demand in the AI-driven data economy,” and WD is focused on delivering “reliable, high-capacity HDDs at scale” to large cloud customers. Indeed, cloud/nearline customers now account for nearly 89% of WD’s revenue, and WD shipped over 3.5 million of its newest high-capacity drives (up to 26 TB CMR and 32 TB UltraSMR) during the quarter. These drives support AI and “multimodal” data workloads, helping to boost both revenue and gross margins (which are up ~770 basis points YoY).

Digital’s high-capacity data center drives are in strong demand. In Q2 the company delivered 215 exabytes of storage (up 22% YoY) and shipped millions of its latest 26–32 TB drives. This reflects surging AI-driven data growth: WD management highlighted “accelerating adoption” of generative AI and cloud applications, which require ever-larger storage systems. Strong mix shifts (toward higher-capacity nearline drives) and cost efficiencies helped lift gross margin by 220 bp sequentially, to a new ~46% level.

Fiscal Q3 2026 Outlook

Western Digital gave very optimistic guidance for the next quarter. CFO Kris Sennesael said Q3 FY2026 revenue is expected around $3.2 billion (about +40% YoY at mid-point), with a non‑GAAP gross margin near 47.5% and non‑GAAP EPS of $2.30. This implies further margin expansion as more high-density drives roll out. Analysts note that WD’s guidance implies ~75% incremental gross margin on the extra revenue. The company reiterated its focus on HAMR and UltraSMR technologies to boost future capacity and efficiency.

- Q3 Revenue (mid-point): ~$3.2B (≈+40% YoY).

- Gross margin (non‑GAAP): ~47–48%.

- EPS (non‑GAAP): ~$2.30.

“Our business continues to strengthen,” Sennesael stated, attributing the solid results to strong data center demand and WD’s advanced high-capacity drives. Wall Street reacted positively: WD’s stock jumped about 2.3% in after-hours trading on the news, trading near its 52-week high.

Dividend and Shareholder Returns

WD’s Board declared a cash dividend of $0.125 per share, payable March 18, 2026 (to holders of record as of March 5). The company has also been aggressively returning cash to investors. In Q2 it repaid over $615 million to shareholders via buybacks and an additional $48 million in dividends. Cumulatively since late FY2025, WD has returned about $1.4 billion to shareholders (repurchases + dividends) – effectively 100%+ of this quarter’s free cash flow.

Key Points: Western Digital’s Q2 2026 results show robust growth driven by AI/cloud demand and high-density HDDs. The company beat guidance on revenue and profit, delivered strong cash flow, and signaled continuing momentum into Q3. Investors will watch how WD executes its technology roadmaps (ePMR, HAMR, UltraSMR) to sustain these trends.

0 Comments